The annual budget of the Union government of India has been placed in Parliament on the February 1, 2020. When Indian economy was undergoing slowdown due to low income and associated low purchasing power of people at aggregate level, the situation has been further compounded by the unforeseen outbreak of the Coronavirus Disease 2019 (COVID-19) pandemic. The economic losses due to the ongoing COVID-19 pandemic have been conspicuously high. A permanent rise in the demand of public health is evident. Temporary rise in unemployment results in millions to become dependent upon government for their basic needs, particularly food. Understandably, such macroeconomic issues posed heightened challenges to the Union Budget 2021-22 as this budget would not only have to address the current challenges but effectively counter the shock brought by the pandemic as well.

Exceptional circumstance needs exceptional policy stance. Against the turbulent times of COVID-19 pandemic, finance minister Nirmala Sitharaman has presented a noteworthy fiscal deficit of Rs. 18,48,655 crores (9.5 percent to GDP) in the revised estimates of 2020-21. At the outset, it is important to mention that such high deficit is “good” if it creates economic expansion during economic slowdown. When this pandemic has put the mettle of robustness of the fiscal policies of the Union government through budgetary allocation to the test, how the recent Union Budget of 2021-22 tries to solve the aggregate demand problem in the economy needs probing. In this context, nonetheless, it would be intriguing to comprehend as to which factors (such as, revenue mobilisation, development spending, investment on infrastructure, interest payments burden, denominator GDP, and so forth) have contributed how to such high fiscal deficit of 9.5 percent of GDP. This is important to understand at the first, which would then enable us to understand the implications of this budget on inflation.

In this regard, the concept of cyclicality of fiscal policy plays a significant role, particularly for this annual budget. Cyclicality of fiscal policy signifies the path wherein the movement of government’s revenues and expenditures is consistent with output. A fiscal policy is realised to be pro-cyclical if it moves in relation with the business cycle, i.e., it is expansionary (government increases expenditures and reduces taxes to boost aggregate demand) during economic booms and contractionary (government increases taxes and reduces expenditures) during economic depressions. Contrariwise, when a fiscal policy moves against the business cycle or output, it is referred to as a counter-cyclical fiscal policy. In other words, the counter-cyclical fiscal policy is expansionary during recessions and contractionary during booms.

Factors Driving Fiscal Deficit

In her third budget speech, finance minister Nirmala Sitharaman mentioned that “The PMGKY, the three AtmaNirbhar Bharat packages, and announcements made later were like five mini-budgets in themselves.” (emphasis added)

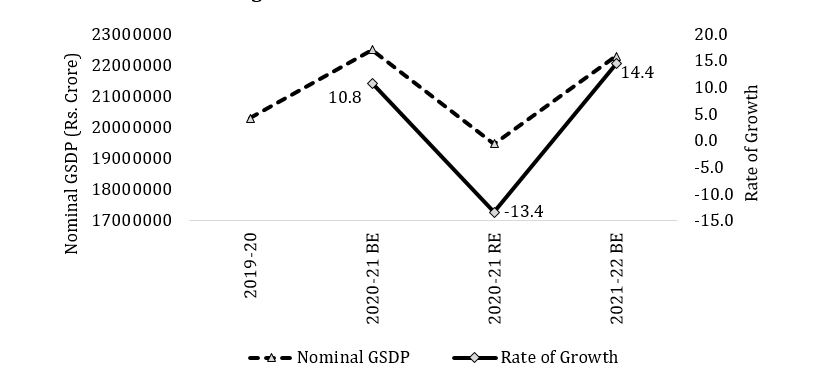

Despite executing huge cash transfers, the Union government’s intent of providing fiscal stimulus packages (five “mini-budgets” in continuum) such as food delivery and capital expenditure (investment on infrastructure) with the aim of giving the economy a massive demand side push, is welcome. The Union government perceived that these fiscal stimulus packages could collectively revive the aggregate demand in the economy, which could lead to high growth in near future (“V-shaped” recovery in 2021-22, see Figure 1), and consequently, the level of fiscal deficit (in both the absolute term and as percent to GDP) would come down, which is estimated to be 6.8 percent in 2021-22. At this moment, therefore, such counter-cyclical expansionary fiscal policy is extremely crucial rather than worrying much about the level of fiscal deficit now.

Figure 1: Nominal GSDP and Its Growth

Source: Union Budget 2021-22 documents, Government of India

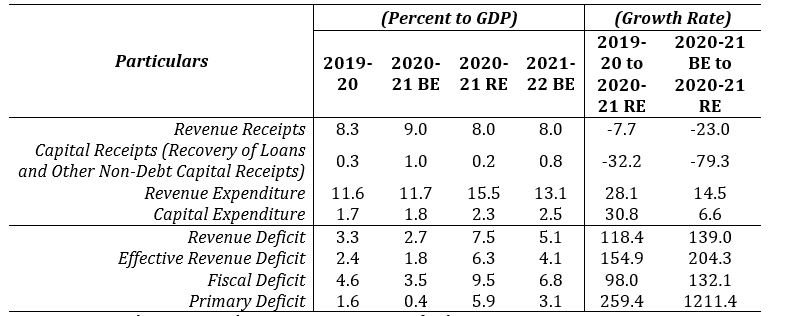

A prolonged period of halt in nationwide economic activities as a response to fight the pandemic caused the revenue contraction. It could be seen from Table 1 that the total revenue receipts have witnessed a negative growth of 7.7 percent from 2019-20 to 2020-21 RE, and 23 percent from 2020-21 BE to 2020-21 RE. On the capital receipts front, the Union government needed to soften the disinvestment (recovery of loans and advances) targets since these targets would be difficult to meet. Thus, as expected, recovery of loans and other non-debt capital receipts have also witnessed negative growths between 2019-20 and 2020-21 RE, and 2020-21 BE to 2020-21 RE.

In contrast, due to the stimulus packages as a measure of expansionary fiscal policy, a spurt has been observed in both the revenue and capital expenditures. In this regard, however, it is particularly important to note the trends of capital infrastructure expenditure. The revised estimates of capital expenditure for 2020-21 have been increased to Rs 4.39 lakh crore against its budgeted amount of Rs 4.12 lakh crore. However, the capital expenditure as percent GDP for the revised estimates of 2020-21 has emerged to be merely 2.3 percent despite the fact that the GDP has witnessed a massive contraction.

Table 1: Trends in Macro-fiscal Variables: COVID-19 related Measures

Source: Union Budget 2021-22 documents, Government of India

Implications on Inflation

There are three reasons, for which, fiscal deficit is referred to as the key indicator of fiscal imbalance. First, it reflects the aggregate resource gap of the government. Secondly, high fiscal deficit can have adverse macroeconomic implications as it results on high interest rate. Thirdly, fiscal deficit can be inflationary.

To finance the high fiscal deficit, the Union government can borrow from the commercial banks and market (with high rate of interests) as much as the lending institutions are willing to invest in the government securities. The residual amount can be borrowed from the Central bank (Reserve bank of India), which would certainly be at much lower interest rate than borrowing from capital market. This is crucial because low revenue mobilisation effort is evident in many states, which is further compounded by the fact of the states’ stringent borrowing limits.

In this context, it is important to discuss the possibility of inflation in future. The evident current demand depression due to low purchasing power of people at aggregate level, the likelihood of the occurrence of demand-pull inflation is simply preposterous. Nevertheless, Cost-push inflation might take place due to the unchanged income tax rates for low and middle-income classes, and higher tax rates on some important goods and services (for instance, petroleum products). In this regard, it could be argued that the government should have cut tax rates (both direct and indirect) as revenue-side stimulus which would give an increase in citizens’ income, which would in turn, boost their purchasing power.

When this budget, by and large, shows a path towards counter-cyclical expansionary fiscal policy to combat the COVID-shock, cuts in expenditures in absolute term by a few important social and economic ministries/departments (such as, Department of Agriculture, Cooperation and Farmers’ Welfare, Department of School Education and Literacy, Department of Higher Education, Ministry of Housing and Urban Affairs, Ministry of Micro, Small and Medium Enterprises, Ministry of Panchayati Raj, Ministry of Power, and a few others) in 2020-21 RE as against 2020-21 BE have been observed, which raised a serious cause of concern.

In sum, revenue contraction, expenditure-side stimulus measures, and low denominator GDP – these three factors have collectively contributed to the high fiscal deficit in 2020-21 RE. Various measures relating to tax and non-tax revenue receipts, disinvestment, ministry/department-wise expenditure trends, and capital infrastructure spending in the Union Budget 2021-22 have generated mixed responses among the economists towards achieving an expansionary fiscal policy. It is, therefore, innocuous to conclude that there is considerable policy space for designing, implementing, and administering the budgetary provisions.

Kausik is Senior Budget Specialist with Primus Partners. Earlier he was Research Analyst with International Budget Partnership (IBP). He holds a PhD in Economics and his areas of expertise include Public Finance and Policy, Fiscal Decentralisation, Fiscal Federalism, Decentralised Public Service Delivery and Public Health.