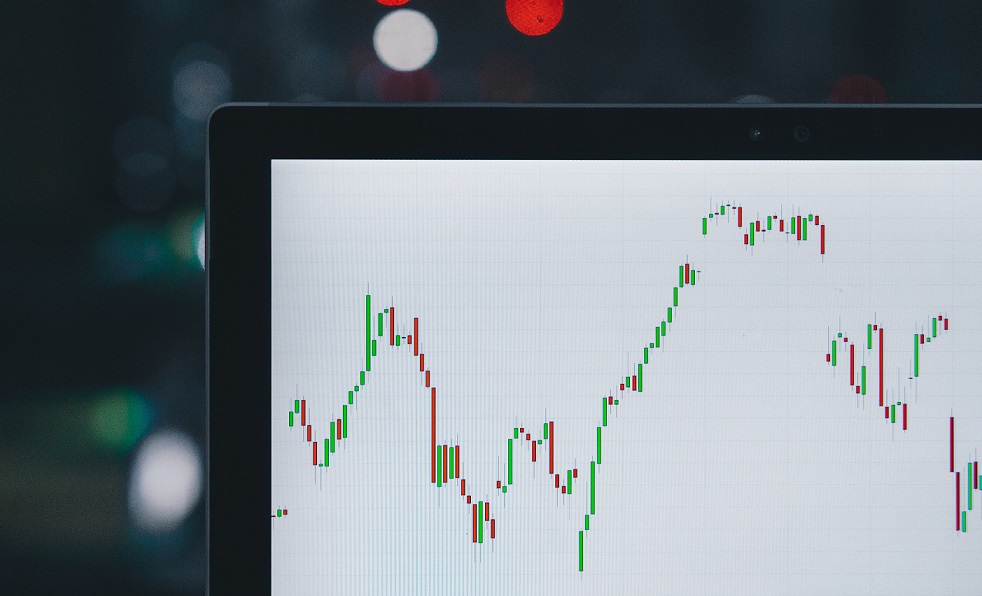

The RBI has surprised the markets by this strong move towards policy sequencing of inflation containment prior to economic growth in the recent MPC meetings. Since May 2020, indeed the policy imperative of RBI has been “whatever it takes” to tackle the economic growth recovery process. However, with the war in Ukraine and mounting inflationary pressures, price stability has become the significant concern for RBI. The ever-mutating coronavirus would continue as a crucial determinant of macroeconomic uncertainties.