Financial Technology aka Fintech refers to the deployment of new technology and innovation to enhance the delivery of financial services. In comparison to the state-of-the-art technology at play in sectors like manufacturing, IT services etc, it is clear that Financial services is clearly lagging behind in the efficient use of technology to make lives better. While customer expectations have gone through the roof, there is a clear gap in this particular industry between what customers have come to expect and what the institutions have been able to deliver. This gap is often attributed to the Financial Crisis of 2008, which led to a call for the prioritization of stability over innovation. Thus around the turn of the decade, we could book a flight from the comforts of home, but had to carry lots of documents physically to the bank to open a bank account.

The landscape is changing, however. A decade having passed since the last major global financial crisis, the world economy is rapidly growing. Investors have renewed confidence. With the seemingly limitless amount of customer data available, analyzing credit worthiness has never been easier. Penetration of smartphones and internet have led to a significant jump in financial inclusion. A key aspect to note about the new entrants is that they have skipped a phase in the transition. Thus, instead of progressing from money in almirahs to banks to digital services, there are people who have never even had a bank account.

India has very high potential for Fintech expansion. Some of the factors that make fintech a highly promising industry in India are:

Unrivalled youth demographic which is rapidly growing

More than 65% of India’s 1.3 billion population is below the age of 35. Having been used to the ease of technology at their fingertips, most of them are loath to brick-and-mortar banking.

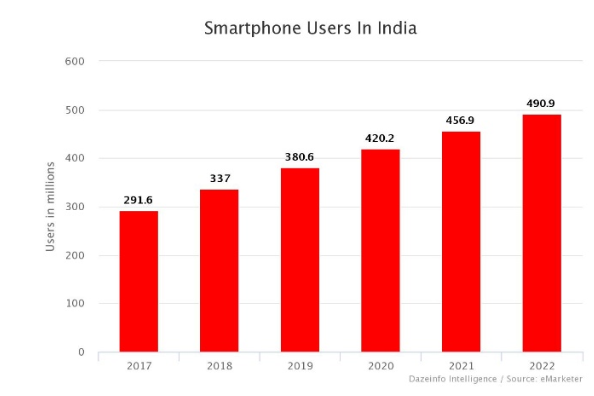

Smartphone penetration

Buoyed by cheaper smartphones, faster connectivity, and affordable services, the number of mobile internet users in India is estimated to touch 490.9 million by 2018.

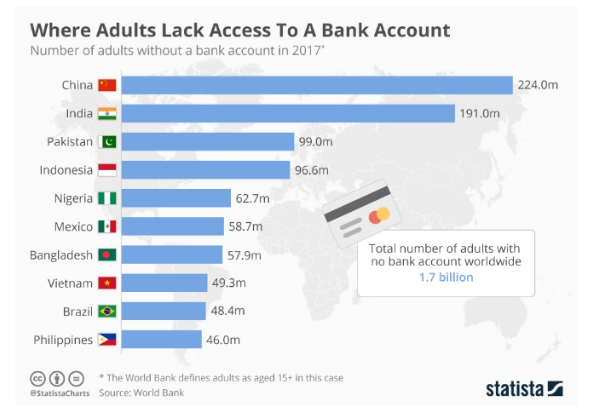

Untapped market

According to an April 2018 World Bank report, India has 19 crore adults without a bank account. What’s more, almost half of account owners had an account that remained inactive in the past year. With the Indian economy getting formalized on account of Demonetisation and GST, there’s likely to a surge in demand for savings and investment instruments.

Aadhaar – will minimize the effort for KYC

KYC is one of the significant challenges faced by Fintech companies around the world. With the introduction of Aadhaar, the customer onboarding process has become significantly smoother, saving companies significant time and hassle.

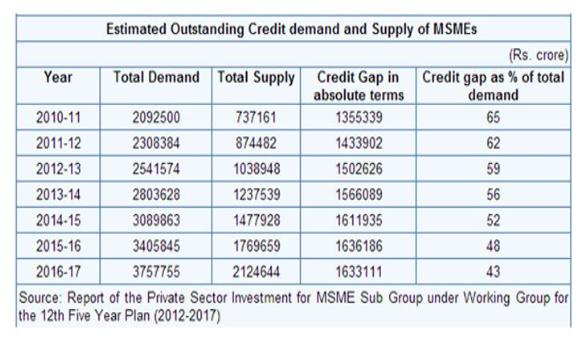

Lending is a massive opportunity, especially for MSMEs

Lack of collateral, missing credit history, lack of documentation and no bank account are some of the major challenges faced by MSMEs in raising credit from the formal banking sector. There exists a huge credit deficit of about USD 2 trillion for the MSMEs. There is a huge opportunity for fintech firms to step in and bridge this gap.

Acknowledging the MSME credit gap in his 2018 Budget address, Finance minister Arun Jaitley assured that his ministry was looking into devising the policy and institutional development measures needed for creating the right environment for fintech companies to grow in India. With more customer data available than ever before, companies are able to evaluate loan applications digitally based on financial performance, business performance, social profile, and statutory compliance.

Digital insurance and savings

The one-size-fits-all approach in traditional Insurance has been obsolete for quite some time. With personalized targeting made possible by analytics, customers will have to realize that they need to pay an extra premium for risky behavior such as poor health and bad driving habits. Conversely, prudent customers can expect to pay less. Going digital also reduces operational costs and the cost advantage can be transferred to the customers.

Digital payment and digital credit lending have taken enormous leaps in India, but the insurance sector is yet to follow suit.

However, there are challenges to be overcome before Fintech can achieve full scale maturity.

Privacy issue – Regulation concerns

The Justice Srikrishna committee submitted the long awaited data protection bill to the IT ministry for review on 27 July. We can only speculate what the final form of the law would look like – but its clear data privacy regulations are at an inflection point in India.

For years, there were no regulations in place, and companies used this to their advantage with customer profiling. The onset of new regulations in this industry is set to pose a new challenge.

Threat of China

The influx of Chinese multinationals in the Indian fintech space has caused the government to sit up and take notice. Current FDI regulations allow 100 percent foreign investment in NBFCs, which has spurred fear of predatory pricing and capital dumping by Chinese companies. Private and financial data of millions of individuals and corporates are also at risk. For instance, Alibaba has applied for NBFC license in India through Paytm where it has a majority stake.

Despite these challenges, it is clear that Fintech in India is still in its infancy and has great potential for growth. As we conclude, here are some of the recent interesting news segments which may herald the future of Fintech in India:

Peer to peer lending platforms

Peer to peer lending is a method of financing that helps individuals borrow and lend money without the use of an official financial institution as an intermediary. P2P is one of the promising avenues of Fintech in India. In April 2016, there were 30 peer to peer lending startups in the country. Since October 2017, rules stipulate that peer-to-peer lenders register with the RBI. Nine months since, only 5 of these lenders are registered.

But RBI regulations have reposed trust in the P2P lending system. Registered Fintech firms are attracting thousands of new lenders each month, and the number of borrowers approaching these companies have also seen a substantial increase. A recent article in the economic times explored the trend among millennials to reach out to fintech startups to finance vacations and getaways.

Bankers

A recent article in economic times talked about how senior bankers are leaving lucrative positions in major banks to start their own ventures. These experienced professionals may set the tone for next generation banking – they have seen the system for years, and know what needs to be fixed and what doesn’t.

DBS – Expansion through Fintech

DBS is converting itself into a banking subsidiary in India. The advantages are clear – removal of restrictions in business expansion in India including the one that pertains to opening of branches, permission to acquire private lenders, permission to open more branches etc. This potentially represents the way forward for traditional banks. Opening and maintaining physical branches takes a drain on the institution’s resources.