India seems to be in the throes of the fast-becoming culpable crime against its very own economy. In the penultimate week, first, the International Monetary Fund (IMF) and later, the Reserve Bank of India has signaled warnings of decelerating growth of the Nation and its underlying ramifications. The Central Bank, in its latest financial stability report, has pointed out that the sharp dialing down of the growth trajectory would lead to a fresh increase in bad debts of banks as businesses pressurized for revenues may go bankrupt. This present pandemonium accompanied by the ongoing circumstances; in-turn reflected on the industrial production numbers from 4.3% in September to a meager 3.8% in October of the present year.

It, therefore, can be safely surmised that the single biggest priority ahead for the government in 2020 would be to kick-start growth.

The Finance Minister, on February 1st, would be facing the most contentious question of whether or not to provide fiscal stimulus. The biggest challenge before her would be to restore one of the twin engines of growth- Consumption, and Investment. This is because consumption has failed to pick up, and private investment has remained stagnant. On a sequentially adjusted annualized rate basis, the GDP growth is at 3.6%. As per the expenditure trends, the private final consumption expenditure grew by 5% in the 2nd quarter compared to 3.1% in the 1st. But this growth is at odds with the evidence coming in from various sectors regarding subdued consumption both in rural as well as urban areas. The gross fixed capital formation grew by 1% in the 2nd quarter as against 4% in the 1st. However, the government final consumption expenditure grew by 15.6%. Corporate indebtedness, risk aversion by banks, and the crisis in the non-banking financial companies have come in the way of investment demand. One of the reasons for deceleration in India is the credit conditions being tight, part of which is a supply-side problem, other than global reasons. In a prolonged period of demand slowdown, this would imply a long period of lower capacity utilization, a delay in the investment cycle, and a decline in long-term potential growth.

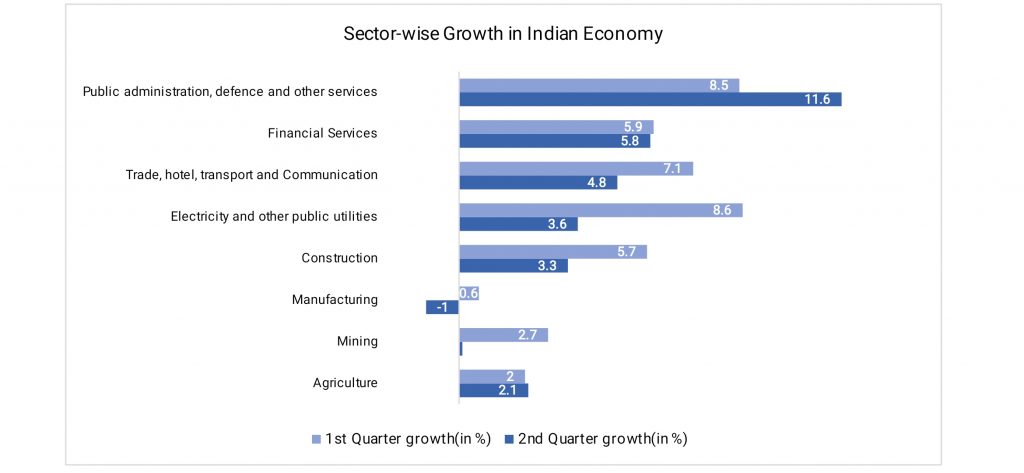

The following chart shows the present sector-wise growth rates over two quarters in 2019:

Source: Bloomberg

Amidst all the hopeless possibilities, this 29th of December published a report whereby the Confederation of Indian Industry (CII) noted nascent signs of recovery in the Purchasing Managers Index (PMI) of manufacturing and services that boosted their expectations of the economy rebounding in 2020.

Now, before getting into the details, it’s extremely crucial to understand what the term “Purchasing Managers Index” exactly means. The Purchasing Managers’ Index (PMI) is an economic indicator that surveys purchasing managers at businesses that make up a given sector. The most common PMI surveys are the manufacturing PMI and the services PMI, which are released for the United States and many other developed countries around the world, including members of the Eurozone. Investors use PMI surveys as leading indicators of economic health, given their insight into sales, employment, inventory, and pricing. After all, manufacturing sector purchases tend to react to consumer demand and are often the first visible sign of a slowdown.

The most common elements of this index include namely, new orders, factory output, employment, suppliers’ delivery times and stocks of purchases with the most common answers being Improvement, No change or Deterioration. The actual formula used to calculate the PMI assigns weights to each common element and then multiplies them by 1 for improvement, 0.5 for no change, and 0 for deterioration. A reading above 50 suggests an improvement, while a reading below 50 suggests deterioration. The groups also divide the survey into the manufacturing and services sectors since manufacturing is export-dependent, and services are more sensitive to the domestic economy. When it comes to predicting GDP growth, a sustained reading of higher than 42 is considered to be the benchmark for economic expansion. A sustained reading below 42 could indicate that an economy is heading into a recession, and the difference between 42 and 50 can indicate the strength of an economic recovery and vice versa for a decline in GDP.

Now in November, amidst all the gloom and doom, the rebound in the services PMI showed an encouraging 52.7 as compared to October’s 49.2. Manufacturing Sector, on the other hand, showed the latest number of 51.2 as against 49.2 in October. These clear signs of recovery along with the jump in passenger air traffic and sharp moderation in the decline in sales in passenger cars do generate significate hope for a possible rebound in 2020 for the country in terms of growth as well as improvements in the initial difficulties associated with Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code (IBC).

CII, since time immemorial, has always believed that with sharp moderation in growth, it’s crucial to adopt Expansionary Fiscal Policy. Just like their medium inflation target range, the organization has proposed to have a flexible fiscal policy target that will set the central target for the fiscal deficit within a range of around 0.5 to 0.75 percent. The additional availability of funds can be spent on key infrastructure projects which can be easily implemented. This would help have a significant multiplier effect on the economy.

In the subsequent years, there can be a glide path to converge to the Fiscal Responsibility and Budget Management trajectory over a 2-3-year time frame. Besides, the chamber has also suggested that in order to increase the tax base and ensure higher compliance, it is necessary to simplify and reduce the number of GST rates and increase its coverage. Once it is converged, the practice of reviewing rates at every meeting of the GST Council must be discontinued. At the same time, a rational structure of customs duty needs to be in place. The principle of higher customs duty on final products with lower duty on intermediate goods and the lowest on raw materials needs to be followed, without exception.

While these signs of recovery do signal a silver lining hopeful of showing up post the dark sky, the economy is heavily relying on the Union Budget to be proposed on February 1st, 2020 with significant spending on infrastructure spending, making the Ayushman Bharat Scheme into a reality and ensuring money in the hands of the lower strata of the economy because it will be the latter that will help us show the light of the day.

Bidisha Bhattacharya works ScrollStack. Prior to

this she was a Consultant to the Fifteenth Finance Commission, Government of India and has worked as a Political Researcher in Prashant Kishor’s Strategic Research and Insights (SRI) team at I-PAC.