“The future of war, is not fighting, but famine, not the slaying of men, but the bankruptcy of nations and the break-up of the whole social organization”.

– Ivan Bloch Russian Rail Tycoon

Today wars are fought with bonds not bombs. War in 21st century will be fought in the field of trade, capital markets, and finance. The world has witnessed a blurring of lines that were once seen as separate and distinct, civilians and enemy combatants are virtually indistinguishable. Everything that can be weaponized has been—from water pipes to the personal computers. “National security” and “economics” are no longer separate policy arenas, they now overlap.

The end of the last millennium saw a dramatic rise in the ratio of foreign trade to global economic output. Between 1800 and 1913, world output per head doubled; over the same period the volume of world trade per capita multiplied by a factor of eleven. This rapid evolution of globalisation and tightly integrated economies was accompanied with a waning popularity of direct warfare. Leaders and policy makers were forced to look for alternative ways of waging war.

The US spearheaded this effort by employing various emergency devices to control their international economic relations- export control, the freezing of foreign funds, blacklisting, shipping control trying keep away from fighting in World War 2 but they ultimately failed. As the Germans overcame the European democracies, one after another, and the Japanese pushed farther down into south-western Asia, economic warfare was converted from a substitute for fighting into a preparation for armed conflict.

Instruments of Economic Warfare

Sanctions

Perhaps the most successful example of the effectiveness of sanctions is the US embargo on Iran to suspend its uranium enrichment program based on Capitol Hill’s fears that Iran would use the enriched uranium to accelerate its nuclear program.

Over the years, these sanctions have taken a serious toll on Iran’s economy and people.

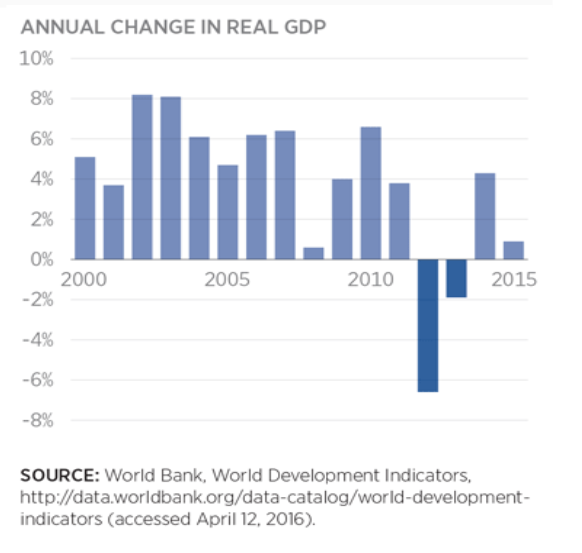

The Sanctions in Iran lead to 2 years of economic contraction and caused significant damage to their economy. The value of the Iranian Rial has plunged since autumn 2011, it is reported to have devalued up to 80%, falling 10% immediately after the imposition of the oil embargo since early October 2012, causing widespread panic among the Iranian public. International companies have also been reluctant to do business with Iran for fear of losing access to larger Western markets.

On 2 April 2015, a provisional agreement was reached between both parties which would lift most of the sanctions in exchange for limits on Iran’s nuclear programs for at least ten years.

Targeting the Engine of the Economy

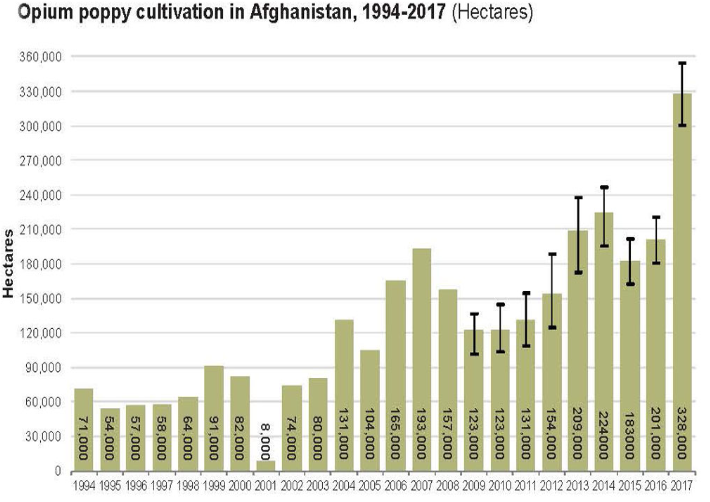

Opium poppy is deeply entangled in the socio-economic fabric of Afghanistan, and hence it influences its political arrangements and power relations. Afghanistan is responsible for 90% of the world’s opium production and the opium poppy economy is massive driver for the Afghan economy. As of 2017, opium production provides about 400,000 jobs in Afghanistan, more than the Afghan National Security Forces. The Taliban has profited massively from the opium trade through a 10 percent tax on farmers, known locally as ushr, and by providing traffickers with protection services. Eventually it grew more sophisticated in its role in the trade and became increasingly involved in processing opium into heroin.

This link between opium income and Taliban resources encouraged the United States to suppress the Afghan opium trade. Attacks by the US and NATO forces on opium production have led to 100,000 deaths a year.

Another mainstream example is the ongoing conflicts involving oil-producing nations which also highlights how economic warfare aids military action. The years following the US invasion of Iraq, for instance, saw extensive efforts to derail Iraqi oil production and sabotage its pipelines.

Monetary Measures and Trade Wars

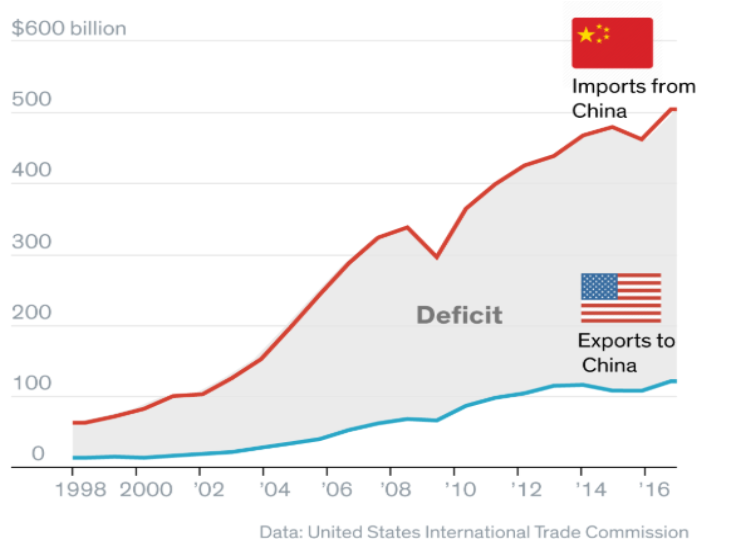

In principle, Monetary measures can be used both as defensive or offensive weapons. As an offensive measure one approach is the devaluation of one’s own currency to reduce the price of own exports. An obvious case to consider is the brewing US-China trade war. China and the U.S. have already been in conflict for years, with China pegging its currency to the dollar, which gave it a trade advantage at certain periods. This was paired along with its aggressive trade policy and subsidies for domestic companies. This lead to a trade deficit of over $375 billion in 2017.

Another approach is to expand ones influence in the world by entering into multiple trade deals and economic partnerships. China has had trade meetings with Russia, Japan, South Korea, the European Union, South American nations and numerous African nations. Trade deals will allow China to lower the costs of its goods by reducing or maybe even eliminating tariffs thereby protecting itself from the effects of future trade wars and trade threats. China is also making itself more economically competitive and integrated into trading zones around the world.

Monetary measures can also be used effectively as a defensive strategy. Post the tariff hike on a number of Chinese goods, buyers and sellers on both sides of the Pacific Ocean felt the burn. Chinese companies lost orders overnight, and U.S. firms began to scale back their orders and manufacturing. In response the Chinese Politburo devalued the yuan. The lower value of the yuan allowed higher levels of trade than what would have been expected after application of Trump’s tariffs which allowed some Chinese firms bear the brunt of the tariff hike.

Freezing foreign funds

During World War 2 the US spearheaded the freezing of foreign assets which began in April 1940 when Germany invaded Denmark and Norway, it has now developed into a comprehensive system of exchange control and an effective engine of economic warfare. Originally, the dominant aim was to protect the owners of the funds. But eventually it was recognized that to keep several billions of dollars out of German hands was indirectly a way of aiding Britain.

Strategies in Economic Warfare

Coercion – After a country achieves a position of economic influence in another, it threatens to stop making purchases, to cut off supplies, or to refuse to pay obligations unless some concession—economic, political, or military—is made. In many cases the victim is maneuvered into a position in which a significant proportion of his trade is controlled by the initiator, or the latter manages to become deeply indebted to the victim. A prime example of this is Modern day China, One of President Xi Jinping’s central foreign policy initiatives, the Belt and Road Initiative (BRI), is a potentially trillion-dollar testament to Beijing’s commitment to using loans, infrastructure projects, and other economic measures to gain economic influence. In the past decade. China has punished countries that undermine its territorial claims and foreign policy goals with measures such as restricting trade, encouraging popular boycotts, and cutting off tourism. These actions have caused significant economic damage to U.S. partners such as Japan and South Korea.

Persuasion– It consists of the use of foreign economic relations to favour another country and thereby win its good will and support. The strategy used is to give more favourable terms of to the intended country-favourable trade terms and low-interest loans. On the basis of these economic favours, a country may expect, in return, reciprocal favours in the form of political support, an alliance, or perhaps neutrality.

Historically the US has been a proponent of this strategy. Between 1934 and 1945, the United States signed 29 reciprocal trade agreements with various Latin American countries to win their support. And in Asia, the administration tried to use the Export-Import Bank to blunt the rise of Japan. The US wanting to spread democracy in the east even arranged a $25 million loan to China in 1938.

Conclusion

As we have seen, in the modern era, sovereign states and multilateral institutions have imposed economic sanctions on dictatorial regimes or would-be nuclear powers as an alternative to waging war .They have conditioned offers of aid, loans, and debt relief on recipients’ willingness to implement market and governance reforms. Economic warfare has also played a supporting function for conventional military conflict. The increasing complexity of our economic partnerships will soon reduce the incentives for armed military combat. Indeed, World War III won’t be fought with guns and atom bombs but with currency and trade embargoes.

Indian Institute of Foreign Trade.