Indian Institute of Foreign Trade

The major catalyst for any country’s economy is the banking sector. It is the major source of financial resources for capital-intensive sectors such as infrastructure, automobiles, iron and steel, industrials and high-growth sectors such as pharmaceuticals, healthcare and consumer discretionary. In emerging economies like India its role grows multi-fold. Apart from acting as agents of financial intermediation banks also have an additional responsibility of realising the governments social reform agenda. Because of this close relationship between banking and economic development, the growth of the overall economy is intrinsically correlated to the health of the banking industry.

What led to the Banking Crisis?

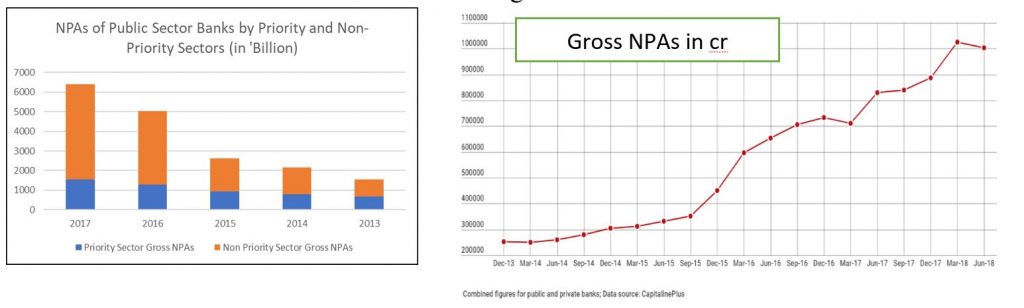

Indian economy was going through a dream run in terms of growth from 2002 to 2008 which led to spiralling of credit growth in the Indian banking sector in excess of 22%. But as the financial crisis struck a slowdown in economic growth started which further resulted in

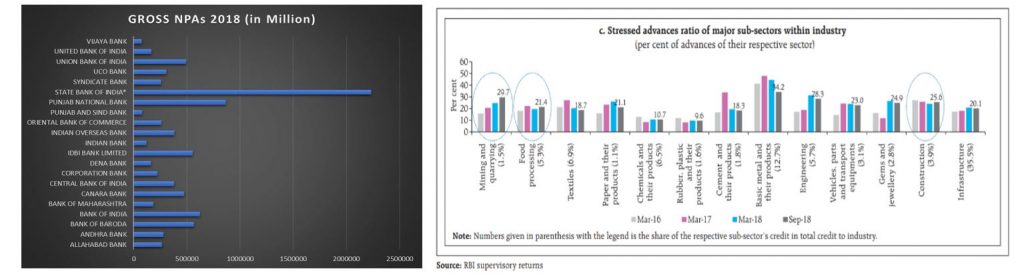

At this point of time an iceberg was created that kept on pilling up every year owing to the inefficiency of existing frameworks to restructure bad loans. Some of these frameworks were Corporate Debt Restructuring, Sustainable Structuring of Stressed Assets or S4A, Strategic Debt Restructuring, and Flexible Structuring of Existing Long-Term Project Loans. A need was felt by the RBI for having proper bankruptcy laws since most of the wilful defaulters were able to find loopholes in the existing schemes which further aggravated the situation for the banks to recover loans. In order to resolve this government first initiated a Banks Board Bureau (BBB) under the leadership of former CAG, Vinod Rai and then brought into effect Insolvency Bankruptcy Code (IBC) in 2016 which further led to scrapping schemes like CDR, SDR, S4A, JLF altogether. During this time the major industries which contributed to stressed assets were infrastructure, metals and the textiles which also got reflected in some of the major companies whose large NPA accounts went for resolution to National Company Law Tribunal (NCLT). Some of these companies included Lanco Infra, Bhushan Power & Steel, Electro Steel, Essar Steel & Alok Industries. When the things were looking to improve considerably another setback struck the banking sector due to PNB fraud and a slowdown in global economy due to trade war which further dragged the NPA recognition process and also led to creation of new NPA’s.

Opinion on Banking Crisis:

NPA situation has definitely improved in comparison to the situation in 2016 or 2017 majorly owing to the scrapping of restructuring schemes and making accelerated recognition of a number of large stressed accounts as NPAs. Another reason for the improvement in Gross NPA ratios is the capital infusion into state-owned banks under the restructuring scheme which has further led to

Suggestions to improve the NPA situation:

- Technology and analytics can play a crucial role in upgrading the monitoring process & in providing insights into the anomalies, risk indicators and trends.

- Major reason for NPAs is lack of due diligence during the sanctioning of loan. In order to resolve this past history revelation by the borrower to the banks should be mandatory and surprise visits by banks should be done in case of any discrepancies.

- Skill sets of the credit teams need to be upgraded from time to time so that proper credit evaluation takes place

- In order to reduce work load on banking employees a separate team can be instituted to look at the accounting records in order to detect any irregularities.

RBI vs Government

An independent central bank working in tandem with the central government with a shared objective of economic growth is the backbone of any economy. An imbalance of power or control between these institutions can be detrimental for the financial health of a state. A central bank has the responsibility of regulating banks, controlling monetary policy, stabilizing the nation’s currency, keeping the unemployment low and preventing inflation among other objectives.

Time and again, there have been instances where the central bank and the central government have been in loggerheads with each other. The recent tussle between RBI asserting its independence and the central government seeking accountability is one of the many such instances. Officials from both the sides indulged in fierce battle through official speeches, social media statements, and press releases. The first sign of trouble was when RBI Deputy Governor Viral Acharya in his speech at IIT Bombay warned that “the risks of undermining the central bank’s independence are potentially catastrophic”.

The points of contention for the disputes have majorly been the following-

- RBI Reserves

The government wanted RBI to free up ₹3,60,000,00 worth of its reserves — approximately 2.1% of past year’s GDP, for transfer to the government. The government used section 7 (1) of the RBI Act of 1934 which states, “the central government may from time to time give such directions to the bank as it may, after consultation with the governor of the bank, consider necessary in the public interest”. The government’s argument for the same was that the RBI is far too conservative in estimating its contingent liabilities and is building reserves in excess of requirements. This excess reserve can be instead used for increasing liquidity in the market by supporting lending of the NBFCs and helping MSMEs. The government is of the opinion that RBI is throttling growth by throttling credit and liquidity in the market which is also getting reflected by a slowdown in credit availability in the NBFCs.

- Easing of PCA (Prompt corrective action) measures

The government has petitioned the RBI to provide some slack in Prompt Corrective Action (PCA) framework. The cash- strapped banks have been struggling to expand their lending base because of the provisioning requirements in order to keep the stressed assets in check. But since its implementation, solvency losses due to failure of 11 PCA banks have declined from Rs 73,500 crore to Rs 34,200 in the past 4 quarters.

- Diluting Basel III norms and stressed assets framework for Indian banks

In February 2018, the RBI kicked off a process for dealing swiftly with stressed assets where a new set of rules mandated all banks to initiate a resolution plan even if there was a single-day-delay in repayment of dues by the large corporate borrowers. This again was a point of contention between the Centre and the RBI. The Allahabad high court noted that the government could examine the possibility of advising the central bank under Section 7 of the RBI act, after power companies took the issues to the courts. This has not been used in 83 years of RBI’s history.

Analysis of the financial health of NBFCs

| Ratios | 2016-17 | 2017-18 |

| Net profit to total income | 13.4 | 15.6 |

| RoA | 1.6 | 1.9 |

| RoE | 6.9 | 8.4 |

| Current liabilities and provisions | 26.7 | 15.4 |

| Net profit | -14.4 | 30.8 |

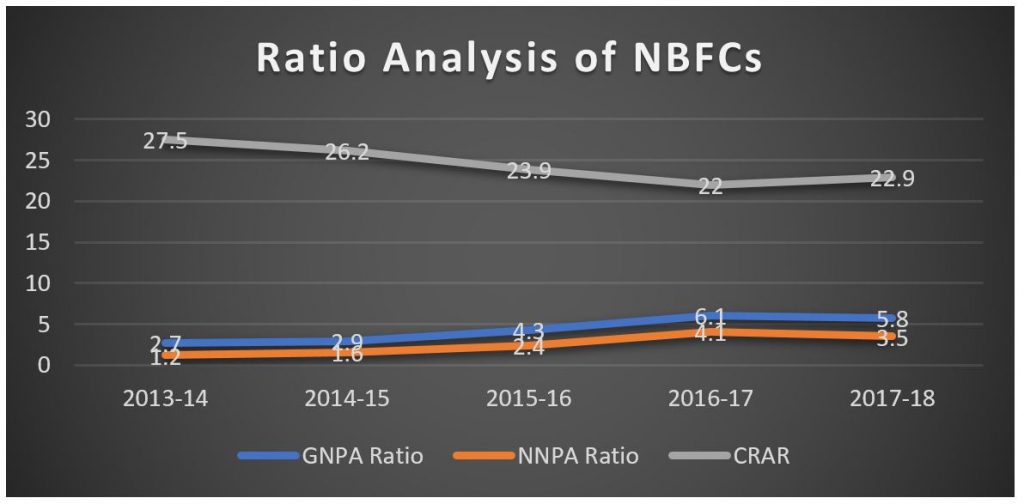

As on March 2018, the aggregate balance sheet size was Rs 22.1 trillion. The net profit has increased to 30.8%. The RoA also increased which implies that assets are able to squeeze out more profits. The current liabilities and provisions have significantly gone down owing to the stricter norms by the RBI. There has been an overall improvement in the financial outlook of the NBFCs.

Asset Quality of NBFCs

There has been a reduction in the Gross NPAs to 3.5% which reflects the success of the corrective measures. CRAR also increased from 22.0 per cent in 2016-17 to 22.9 per cent in 2017-18. CRAR is the measure of capital adequacy with respect to the riskiness of the assets or loans given.

Thus, the quality of operating NBFCs have improved over the years and they have capitalized the dismal condition of the Banking sector which is debt laden. Also, the NBFCs have reacted positively to the regulatory frameworks introduced by RBI.

Opinion on the tussle between RBI & Government Thus, on the one hand the government stand for increasing liquidity is important for the growth of the economy is credible, so is the requirement of stricter norms to regulate the lending practices of NBFCs. The real problem is breakdown in the communication between the two institutions. It’s only natural to have a divergent view on various policy matters. But, while addressing those differences, both the institutions must come together and deliver outcomes through a closed room negotiation, rather than going public.

Indian Institute of Foreign Trade.