Abstract:

The Micro, Small and Medium Enterprises (MSME) sector in India is crucial for the economy in terms of its employment generation capacity, contribution to output as well as growth. This paper studies how the coronavirus-induced lockdown and subsequent halting of all economic activity, led to a major blow to this sector because of physical restrictions on worker movement, supply chain disruption and liquidity crunch. The paper also discusses the Indian government’s response to alleviating these problems, especially with focus on its COVID-relief package. Major concerns surrounding these measures are looked into, including their limited reach, institutional high risk perception and scepticism when it comes to extending liquidity to MSMEs. Keeping these issues in mind, certain policy prescriptions, requiring state support and guarantees, have also been made. That the comeback of the MSME sector is crucially linked to the broader economic outlook and recovery, has been emphasized.

Key Words: MSMEs, COVID-19, economic disruption, microfinance, liquidity, risk perception

India’s Micro, Small and Medium Enterprises (MSMEs), employing about 11.10 crore people and accounting for around 45% of the total manufacturing output as well as 27% of GDP (as of 2017), have been significant contributors towards the country’s economy in a myriad ways. MSMEs create massive employment opportunities, primarily concentrated in the semi-skilled and unskilled labour segments, while also accelerating the economic development of semi-urban and rural pockets, areas that are inadequately represented in the national income distribution and growth narratives. It is also a high growth sector, with its growth having exceeded 10% per annum numerous times in the previous decade, thus demonstrating its potential for significantly shaping and perhaps even leading India’s economic trajectory, if it is provided with an optimal policy environment.

The Indian MSME sector has been severely impacted by the COVID-19 pandemic and the subsequent stringent and protracted nationwide lockdown, which took away the jobs of at least 121 million people (mostly in the informal sector) within just a month of its commencement. The travel restrictions imposed a heavy blow to the entire supply chain, affecting both the input and output sides of production. These inefficiencies in sourcing of raw material and migrant labourers (who had migrated back to their native villages) and delivering finished products, persisted to some extent even after the lockdown started lifting gradually. Challenges on the financial front – pertaining to salary payments, debt obligations and adequate liquidity – threatened to be equally, if not more, threatening. These threats were even graver for the MSMEs than for their larger counterparts due to their limited access to funding, which in many cases is informal, unregulated and expensive.

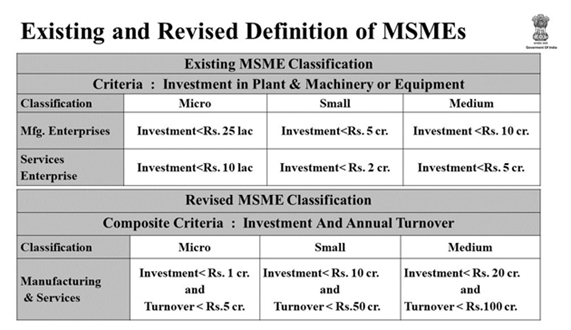

To mitigate these risks, the Indian government rolled out MSME-specific measures in its INR 20 trillion relief package, which included INR three lakh crore worth of collateral-free loan (with a limit of 20% of existing debt to be sanctioned) with 100% credit guarantee and INR 50 thousand crore worth of equity infusion, among few others pertaining to employee benefits, disbursement of pending dues and disallowance of global bids for certain projects. Further, the ministry of MSMEs updated the definitions of MSMEs themselves (as has been displayed in Figure 1), revising the investment ceilings upwards, introducing turnover limits and removing the distinction between manufacturing and service enterprises for all categories. These revisions should enable more enterprises to reap funding and other benefits of the MSME classification provided by the government.

It has been estimated that the aforementioned government measures would be able to effectively reach only about 45 lakh of the 6.6 crore MSMEs in our country, due to various regulations at the creditors’ levels. MSMEs are currently (and are expected to remain) the worst hit, with their earnings having declined by around 20-50%, further backing the inefficiency of the government’s relief. Many MSMEs have laid off their workers and halted production. Much of this impact can be carefully attributed to the funding crunch faced by the MSMEs, which has not been resolved at the ground level despite the government’s apparent focus on liquidity issues. It would certainly help to have a closer look at the funding sources of MSMEs.

Since the imposition of the nationwide lockdown in late March this year, RBI has cut the repo rate by some 115 basis points to settle at 4%, a move which significantly lowers the borrowing costs for commercial banks, who further lend to other institutions like non-banking financial companies (NBFCs) and microfinance institutions (MFIs), who in turn are a major source of debt financing for MSMEs. Unfortunately, the latter institutions run on a very thin margin of liquidity and have incurred a significant chunk of defaults in the recent past. With the minimum amount of default to initiate insolvency proceedings under the Insolvency and Bankruptcy Code (IBC) being revised upwards from INR one lakh to INR one crore, there is no immediate recourse for adequate redressal of defaults. Thus, they are extremely wary of risky bets at a point where their liquidity potential is anyway severely constrained, and are refraining from lending out funds to first-time borrowers or borrowers with a marred credit history. According to many media reports, some financiers have outrightly denied fresh guidelines for advanced fund disbursement being communicated to them via the authorities. Even the firms that are able to receive credit are able to do so only at much higher rates ranging anywhere between 8-14%, depending on the perceived risk.

The reasons behind this institutional risk perception and skepticism of MSMEs need to be looked into carefully. Apart from the unpleasant history of defaults, even the future prospects for the MSME sector do not seem so great. As of now, an effective plan for the economy’s post-COVID recovery has not been clearly charted out, and the economic slowdown led by a consumption slump, which had been in progress much before the pandemic struck, could continue. Many of the above highlight some long-term structural issues as well, and would need solutions that are similarly inclined.

The rift between the supply and demand of funds for MSMEs is not driven by availability of these funds as much as it is by the higher perception of risk, and this is where the government needs to work on mitigating the market failure. Expansion of credit guarantee schemes (and not just for already solvent firms, as has been done under the relief programme) could immediately catalyse liquidity transfusion to even the riskier (but needier) firms. A careful consideration must be given to whether some portion of the outstanding MSME debt and running cost obligations to the state (e.g. water, electricity bills) could be waived off till the pandemic has passed and the economy gets back on track, keeping the state capacity in mind. Wage guarantees for this period for workers in this sector could also be a viable fiscal alternative.

Focusing on institutionalising loan restructuring for MSMEs could ameliorate the structural long-run issue of high defaults. Further, apart from all this supply side facilitation, the government must start thinking about the demand side of the economy since its deceleration has been at the core of the chronic economic slowdown, which has certainly impacted the MSMEs adversely. Creating a positive outlook for the economy as a whole could reassure financing institutions of the scope for the MSME segment to bounce back and grow better than before, and their push could actually make this happen.

Figure 1(Source: Ministry of MSME, 2020)

REFERENCES

- Annual Report 2019-20. (n.d.). Retrieved from https://msme.gov.in/sites/default/files/FINAL_MSME_ENGLISH_AR_2019-20.pdf

- Syal, S. (2015). Role of MSMEs in the Growth of Indian Economy. Global Journal of Commerce and Management Perspective, 4(5), 40-43.

- Kapuria, D. (2015). MSME SECTOR: EPITOMISING VITALITY. Retrieved November 26, 2020, from https://www.makeinindia.com/article/-/v/nurturing-a-manufacturing-culture

- Jaffrelot, C., & Thakker, H. (2020, November 10). Covid-19, Amplifying the Return of Mass Poverty in India. Retrieved November 29, 2020, from https://www.institutmontaigne.org/en/blog/covid-19-amplifying-return-mass-poverty-india

- Tripathi, A. (2020, September 23). Covid-19 affect on Micro, Small and Medium Enterprises (MSMEs). The Times of India. Retrieved November 29, 2020, from https://timesofindia.indiatimes.com/blogs/agyeya/covid-19-affect-on-micro-small-and-medium-enterprises-msmes/

- India: Measures in response to COVID-19. (2020, April 13). KPMG. Retrieved November 29, 2020, from https://home.kpmg/xx/en/home/insights/2020/04/india-government-and-institution-measures-in-response-to-covid.html

- MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES NOTIFICATION. (2020, June 1). Retrieved November 29, 2020, from https://msme.gov.in/sites/default/files/MSME_gazette_of_india.pdf

- Balakrishnan, B., & Srinivasan, S. (2019, July 05). What makes NBFCs a better choice for lending to MSME sector. Retrieved November 29, 2020, from https://economictimes.indiatimes.com/markets/stocks/news/what-makes-nbfcs-a-better-choice-for-lending-to-msme-sector/articleshow/70082947.cms?from=mdr

- Why impact of repo rate cut on lending rates is not immediate – Find out. (2020, July 10). Financial Express. Retrieved November 29, 2020, from https://www.financialexpress.com/money/your-money-why-impact-of-repo-rate-cut-is-not-immediate/2018854/

- Verma, S. (2020, June 22). High rates, low demand: Stressed MSMEs can’t tap into Govt relief. The Indian Express. Retrieved November 29, 2020, from https://indianexpress.com/article/india/msme-credit-funds-covid-economic-package-6470200/

- Mehrotra, S., & Raghunathan, K. (2020, July 2). MSME relief package is a damp squib. The Hindu Business Line. Retrieved November 30, 2020, from https://www.thehindubusinessline.com/opinion/msme-relief-package-is-a-damp-squib/article31964254.ece

- Natti, S., Chowdhury, J. R., & Malik, B. (2020, May 24). Rs 3 lakh crore relief, did they say? MSMEs are still struggling to find the money and how! The New Indian Express. Retrieved November 30, 2020, from https://www.newindianexpress.com/business/2020/may/24/rs-3-lakh-crore-relief-did-they-say-msmes-are-still-struggling-to-find-the-money-and-how–2147147.html

- Ghosh, S. (2020). Examining the Covid-19 Relief Package for MSMEs. Economic and Political Weekly, 55(22). Retrieved November 30, 2020, from https://www.epw.in/journal/2020/22/commentary/examining-covid-19-relief-package-msmes.html

Ankita Nayak is pursuing her Bachelor's in Economics from Lady Shri Ram College for Women, University of Delhi. She aims to pursue a career in economic research and policy. Her writing has previously been featured in the Economic and Political Weekly.